Author: Admin

Date: Sep 03, 2018

China Smart Meter Market Capacity Forecast

China Smart Meter Market Capacity Forecast

1. Smart meter market capacity measurement reference index

The smart meter market capacity is generally composed of three dimensions: the number of uninstalled users, the number of new users, the number of failures or rotation, and these three dimensions are composed of a number of reference indicators:

① New user index composition

a) The number of completed residential units of real estate development enterprises nationwide

b) The change rate of the number of completed residential units in real estate development enterprises nationwide

c) The change rate of the number of completed residential units of rural households

d) The number of completed residential units of rural households

e) The proportional relationship between the number of new users of the State Network and the Southern Network

② Indicators of the number of users are not installed

a) The number of users is not installed at the end of each year

③ Number of failures or rotations

a) Number of replacement failures per year

b) Number of rotations per year

④ Number of customers in the scope of business

⑤ The proportion between the number of new installations and the number of tenders

Note: Completed housing means that it has been delivered, so the calculation is based on completed housing.

1.1 Number of completed residential units of real estate development enterprises in China

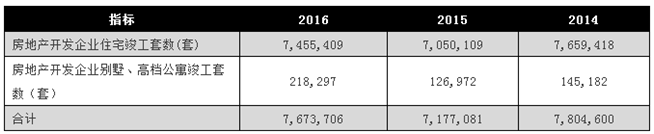

According to the data released by the National Bureau of Statistics, the number of completed residential units of real estate development enterprises in China from 2014 to 2016 is shown in Table 1.

According to the data released by the National Bureau of Statistics, the number of completed residential units of real estate development enterprises in China from 2014 to 2016 is shown in Table 1.

From the above data, it can be found that the number of completed units in 2015 decreased by 8.04% compared with 2014, and the number of completed units in 2016 increased by 6.92% compared with 2015. Combined with the real estate market price and policy changes since 2014, the newly started area of commercial residential housing in 2015 was reduced from 1,291.52 million square meters in 2014 to 1,0999.697 million square meters, and the market supply declined, so there was a new round of price increases from the end of 2015 to the first half of 2016. Since the second half of 2016, in order to control the rapid growth of housing prices in major cities across the country, on the one hand, increasing supply (the newly started area of commercial residential buildings in 2016 increased from 1,099,997 million square meters in 2015 to 119,5727,400 square meters), so the overall number of completed units in 2016 also increased. According to this situation, before the current real estate market environment has not changed significantly and the real estate policies of local governments to expand supply have not changed, it is expected that the number of completed units in 2017 will continue to grow compared with 2016, and 2018 will also continue to grow compared with 2017. But at the same time, considering that the real estate market has entered a plateau, the growth rate of completed units in 2018 is unlikely to still reach the 6.92% of 2016, referring to the market conditions and changes in the number of completed units from 2013 to 2014 (7,619,577 commercial residential units completed in 2013). The number of completed commercial residential units in 2014 was 7,804,600, and the number of completed units in 2017 and 2018 is expected to increase by about 2.5% over the previous year. However, considering that the growth of the newly started area of commercial residential housing is not sustainable, it is expected that the change rate of completed units during 2019 to 2021 will be slightly oscillating on both sides of the zero line. After comprehensive consideration, the change rate of completed units during 2019 to 2021 is set at 0%.

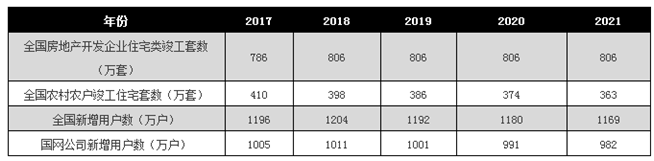

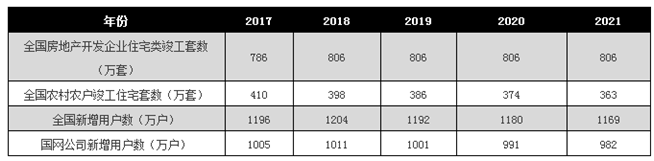

According to the above calculation results, the number of completed residential units of real estate development enterprises in the country from 2017 to 2021 is shown in Table 2.

According to the above calculation method, the number and changes of completed rural household houses in China during 2013 to 2015 can be calculated, as shown in Table 3.

According to this, we can find that the number of completed housing units of rural farmers is decreasing every year. Based on the changes between 2014 and 2016, we can set the rate of change in the number of completed residential units of rural households in 2017 and beyond as an average annual decrease of 3%. According to this, the number of completed residential units of rural households in the country during 2017 to 2021 can be calculated, as shown in Table 4.

1.3 Proportional relationship between the number of new users of the State Network and the Southern Network

According to the data released by the State Grid Corporation, as of 2017, the number of customers served within the scope of business was 447 million; In addition, according to the data released by the Southern Power Grid Company, as of 2017, the number of customers served within the scope of business was 84.97 million. According to this calculation, the number of customers of the State Grid company accounts for 84%, and the number of customers of the Southern Power Grid company accounts for 16%.

29.1.4 Rules for Calculating the Number of Annual Fault Table Changes

We define Y(n) as the failure rate of operation in different years, and the maximum proportion of on-site operation failure table required in the format contract of State Grid Corporation shall not exceed 1%. And the service life of more than 10 years, and the supplier evaluation for different operating years of the evaluation coefficient f(n) difference within 7 years are 10%, Y (n) corresponds to the value can be set to Y (1) = 1%, Y (2) = 1.1%, Y (3) = 1.2%, Y (4) = 1.3%, (5) Y = 1.4%, (6) = 1.5% Y, Y (7) = 1.6%, Y = 1.7% (8), Y (9) = 1.8%, Y (10) = 1.9%.

Failure number (2017) = actual installation (2016) * Y (1) + actual installation number (2015) * Y (2) + actual installation number (2014) * Y (3) + actual installation number (2013) * Y (4) + actual installation number (2012) * Y (5) + actual installation number (2011) * Y (6)

2 Forecast of smart meter market capacity of State Grid Corporation

According to the data released by the State Grid Corporation, in 2017, the State Grid Corporation operated 37.487 million new smart electricity meters in the region, of which 14.314 million households in villages and towns were renovated. By the end of 2017, the operation area of the State Grid Corporation covers 26 provinces (autonomous regions and municipalities directly under the Central government), covering more than 88% of the land area, supplying power to more than 1.1 billion people, and the cumulative number of smart energy meters installed has reached 424 million households. According to the data released by the 2017 Social Responsibility report of the State Grid, as of the end of 2017, the number of customers served by the State Grid company was 447 million, and 23 million households still had not installed smart meters.

Table 2 The number of completed residential units of real estate development enterprises in China from 2017 to 2021

1.2 Number of completed residential units of rural households

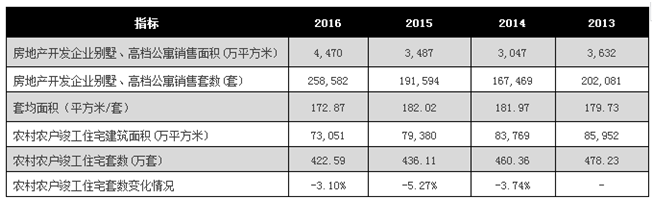

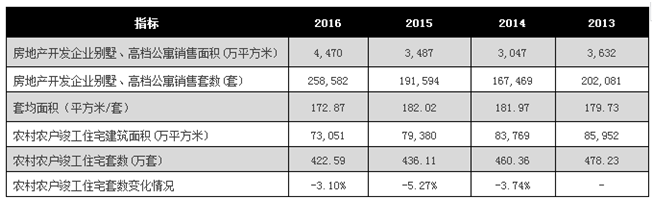

According to the data released by the National Bureau of Statistics, in 2016, the total sales area of villas and high-end apartments in the country was 44.7 million square meters, and the total number of villas and high-end apartments sold by real estate development enterprises in the same year was 258,582, and the average area of villas and high-end apartments was 172.87 square meters/set. According to the data on the completed construction area of rural households released by the National Bureau of Statistics, the total construction area of rural households in 2016 was 730.542 million square meters. Considering that the residential area of rural households is generally large, the average area of rural households is approximately treated with the average area of villas and high-end apartments. That is 172.87 square meters per set.

According to the data released by the National Bureau of Statistics, in 2016, the total sales area of villas and high-end apartments in the country was 44.7 million square meters, and the total number of villas and high-end apartments sold by real estate development enterprises in the same year was 258,582, and the average area of villas and high-end apartments was 172.87 square meters/set. According to the data on the completed construction area of rural households released by the National Bureau of Statistics, the total construction area of rural households in 2016 was 730.542 million square meters. Considering that the residential area of rural households is generally large, the average area of rural households is approximately treated with the average area of villas and high-end apartments. That is 172.87 square meters per set.

According to the above calculation method, the number and changes of completed rural household houses in China during 2013 to 2015 can be calculated, as shown in Table 3.

Table 3 Changes in the number of completed residential units of rural households

According to this, we can find that the number of completed housing units of rural farmers is decreasing every year. Based on the changes between 2014 and 2016, we can set the rate of change in the number of completed residential units of rural households in 2017 and beyond as an average annual decrease of 3%. According to this, the number of completed residential units of rural households in the country during 2017 to 2021 can be calculated, as shown in Table 4.

Table 4: The number of completed residential units of rural households in China from 2017 to 2021

1.3 Proportional relationship between the number of new users of the State Network and the Southern Network

According to the data released by the State Grid Corporation, as of 2017, the number of customers served within the scope of business was 447 million; In addition, according to the data released by the Southern Power Grid Company, as of 2017, the number of customers served within the scope of business was 84.97 million. According to this calculation, the number of customers of the State Grid company accounts for 84%, and the number of customers of the Southern Power Grid company accounts for 16%.

From the perspective of population, as of 2016, the total population of the country is 1.382 billion, and the service population of the State Grid Company is more than 1.1 billion, so it is estimated that the population within the business scope of the State Grid company is 79.6%, while the population within the business scope of the Southern Power Grid Company is 20.4%.

Based on the above information, the average household population within the business scope of the State Grid Company is 2.46 people, and the average household population within the business scope of the Southern Power Grid company is 3.32 people. It can be judged that the speed of new housing within the business scope of the State Grid company should be faster than that of the Southern Power Grid company. Accordingly, the proportion of the number of customers is used as the proportion of the number of new users, that is, the new users of the State Grid company account for 84%, and the new users of the Southern Power Grid company account for 16%.

29.1.4 Rules for Calculating the Number of Annual Fault Table Changes

We define Y(n) as the failure rate of operation in different years, and the maximum proportion of on-site operation failure table required in the format contract of State Grid Corporation shall not exceed 1%. And the service life of more than 10 years, and the supplier evaluation for different operating years of the evaluation coefficient f(n) difference within 7 years are 10%, Y (n) corresponds to the value can be set to Y (1) = 1%, Y (2) = 1.1%, Y (3) = 1.2%, Y (4) = 1.3%, (5) Y = 1.4%, (6) = 1.5% Y, Y (7) = 1.6%, Y = 1.7% (8), Y (9) = 1.8%, Y (10) = 1.9%.

The formula for calculating the number of faults is as follows:

Failure number (2017) = actual installation (2016) * Y (1) + actual installation number (2015) * Y (2) + actual installation number (2014) * Y (3) + actual installation number (2013) * Y (4) + actual installation number (2012) * Y (5) + actual installation number (2011) * Y (6)

Failure number (2018) = actual installation (2017) * Y (1) + actual installation number (2016) * Y (2) + actual installation number (2015) * Y (3) + actual installation number (2014) * Y (4) + actual installation number (2013) * Y (5) + actual installation number (2012) * Y (6) + number of actual installation (20 11)*Y(7)

And so on.

2 Forecast of smart meter market capacity of State Grid Corporation

According to the data released by the State Grid Corporation, in 2017, the State Grid Corporation operated 37.487 million new smart electricity meters in the region, of which 14.314 million households in villages and towns were renovated. By the end of 2017, the operation area of the State Grid Corporation covers 26 provinces (autonomous regions and municipalities directly under the Central government), covering more than 88% of the land area, supplying power to more than 1.1 billion people, and the cumulative number of smart energy meters installed has reached 424 million households. According to the data released by the 2017 Social Responsibility report of the State Grid, as of the end of 2017, the number of customers served by the State Grid company was 447 million, and 23 million households still had not installed smart meters.

2.1 The number of new users of State Grid Corporation from 2018 to 2021

According to the analysis in sections 29.1.1, 29.1.2 and 29.1.3, the number of new users of State Grid Company from 2017 to 2021 is calculated as shown in Table 5.

Table 5 The number of new users of State Grid Company during 2017 to 2021

2.2 Market capacity of State Grid Corporation from 2018 to 2021

From the overall trend of the State Grid Corporation, because the object-oriented protocol is still in the initial stage of implementation, there are still a large number of enterprises fail to obtain the test report of object-oriented protocol products, and the State Grid Corporation plans to complete the transformation and release of the IR46 standard in 2018 at the same time as the national standard. Therefore, it is expected that in 2018 and 2019, new users, fault meter replacement and early meter replacement will continue to be the main, so the demand is expected to be small and stable; Starting from 2020, there will be a planned and rhythmic comprehensive promotion of products that meet both IR46 and object-oriented protocols, and the demand will increase greatly.

From the overall trend of the State Grid Corporation, because the object-oriented protocol is still in the initial stage of implementation, there are still a large number of enterprises fail to obtain the test report of object-oriented protocol products, and the State Grid Corporation plans to complete the transformation and release of the IR46 standard in 2018 at the same time as the national standard. Therefore, it is expected that in 2018 and 2019, new users, fault meter replacement and early meter replacement will continue to be the main, so the demand is expected to be small and stable; Starting from 2020, there will be a planned and rhythmic comprehensive promotion of products that meet both IR46 and object-oriented protocols, and the demand will increase greatly.

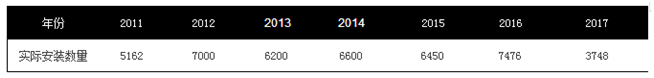

According to the latest policy of the State Grid Corporation, it will continue to implement the full life cycle tracking of on-site smart meters by means of state evaluation to reduce cyclical rotation, so the number of replacement of faulty meters will be considered in the market capacity prediction in 2018 and 2019, and the number of rotation of old meters will be basically not considered. The number of fault meters will be calculated according to the actual installation of smart meters in the State Grid over the years, as shown in Table 6.

Table 6 The actual number of smart meters installed by the State Grid over the years (ten thousand)

Market capacity in 2017:

According to the above theoretical estimates, the number of new users in 2017 was about 10.05 million; At the end of 2016, the number of uninstalled users was about 43 million. The number of fault tables that need to be replaced is about 4.81 million, that is, (7476×1%+6450×1.1%+6600×1.2%+6200×1.3%+7000×1.4%+5162×1.5%) ×10000. The overall market capacity is about 57.86 million. According to the final bidding results, the number of new tenders is 38.19 million, and the coverage rate of market capacity is 66%.

According to the above theoretical estimates, the number of new users in 2017 was about 10.05 million; At the end of 2016, the number of uninstalled users was about 43 million. The number of fault tables that need to be replaced is about 4.81 million, that is, (7476×1%+6450×1.1%+6600×1.2%+6200×1.3%+7000×1.4%+5162×1.5%) ×10000. The overall market capacity is about 57.86 million. According to the final bidding results, the number of new tenders is 38.19 million, and the coverage rate of market capacity is 66%.

Market capacity forecast for 2018:

In 2018, the number of new users is expected to be about 10.11 million; At the end of 2017, the number of uninstalled users was about 23 million. The estimated number of fault tables to be replaced in 2018 is about 5.57 million, that is, (3,7448.7 ×1%+7476×1.1%+6450×1.2%+6600×1.3%+6200×1.4%+7000×1.5%+5162×1.6%) × 10,000. The overall market capacity is about 38.68 million.

However, the second batch of smart meters in 2017, totaling 17.27 million, will not be available until 2018; Secondly, according to estimates, a total of 20.92 million meters of the first batch of bidding in 2017 is expected to have an overall supply rate of about 60%, plus some meters of the individual network provinces and 2016 tenders have not yet been supplied, that is, there should be nearly 10 million meters unsupplied. According to the performance of the contract in the past two years, it is expected that the supply rate of 10 million tables in 2018 is expected to be 80%, while the supply rate of 17.27 million tables in the second batch in 2017 is expected to be 60%, and the two parts will add up to more than 18 million tables in 2018. In addition, there should be a total of about 2 million inventory tables for each network province in the supplied part. Therefore, in order to cover the full market capacity of 38.68 million, 18.68 million will need to be solicited in 2018. However, according to experience, the bidding matching degree of market capacity is generally not more than 70%, that is, the remaining actual demand should be about 9 million; At the same time, from the perspective of the performance of the last two years, the compliance rate of the first batch of electricity meters for bidding in the current year basically did not exceed 60%, so it is expected that the bidding volume of the first tender in 2018 should be about 15 million; At the same time, taking into account the demand in 2019, at least 13 million smart meters need to be tender in the second half of 2017, so it is expected that the overall bidding volume in 2018 should be about 28 million meters.

Market capacity forecast for 2019:

It is estimated that 10.01 million new users will be added in 2019, 11 million users will not be installed at the end of 2018, and 6.39 million fault tables will be replaced in 2018. Namely (2800 x 1.1% + 3748.7 x 1% + + 6450 x 7476 x 1.2% 1.3% + + 6200 x 6600 x 1.4% 1.5% + + 5162 x 7000 x 1.6% 1.7%) by 10000. The total market capacity is about 28 million, but considering that the new standard meters will be fully launched in 2020, the bidding in the second half of 2019 is likely to be large, so there may be a situation in 2019 that the bidding volume significantly exceeds the actual market capacity in 2019, if this happens, The volume of bidding in 2019 is likely to reach more than 40 million.

2020 Market capacity forecast:

With the comprehensive improvement of the IR46 standard value in 2019, it is expected that the State Grid Company will fully start to use the new standard smart meters in 2020. According to a conservative estimate, combined with the standard that the depreciation cycle of measuring equipment assets is 6 to 9 years, at least the equipment installed in 2011 will be fully replaced, considering that some of the damaged equipment has been replaced. But at least there will still be more than 40 million watches can be replaced, coupled with new users, is expected to exceed 50 million demand.

Market capacity forecast for 2021:

Market capacity forecast for 2019:

It is estimated that 10.01 million new users will be added in 2019, 11 million users will not be installed at the end of 2018, and 6.39 million fault tables will be replaced in 2018. Namely (2800 x 1.1% + 3748.7 x 1% + + 6450 x 7476 x 1.2% 1.3% + + 6200 x 6600 x 1.4% 1.5% + + 5162 x 7000 x 1.6% 1.7%) by 10000. The total market capacity is about 28 million, but considering that the new standard meters will be fully launched in 2020, the bidding in the second half of 2019 is likely to be large, so there may be a situation in 2019 that the bidding volume significantly exceeds the actual market capacity in 2019, if this happens, The volume of bidding in 2019 is likely to reach more than 40 million.

2020 Market capacity forecast:

With the comprehensive improvement of the IR46 standard value in 2019, it is expected that the State Grid Company will fully start to use the new standard smart meters in 2020. According to a conservative estimate, combined with the standard that the depreciation cycle of measuring equipment assets is 6 to 9 years, at least the equipment installed in 2011 will be fully replaced, considering that some of the damaged equipment has been replaced. But at least there will still be more than 40 million watches can be replaced, coupled with new users, is expected to exceed 50 million demand.

Market capacity forecast for 2021:

By 2021, the smart meters installed in 2012 will be able to rotate, according to the number of installations in 2012, it is expected that at least 50 million meters need to be replaced, coupled with new users, it is expected that there will be nearly 60 million smart meters demand.